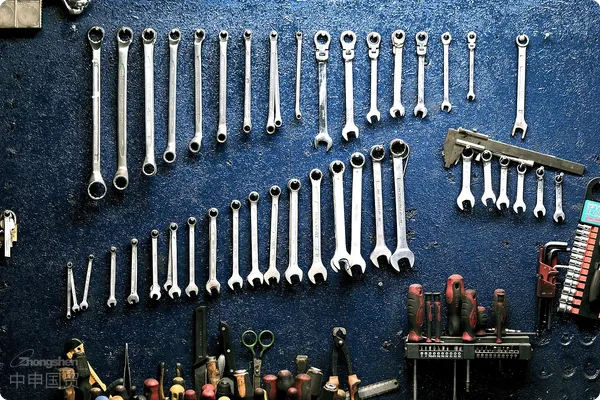

Exporting Construction Tools to the U.S.: How to Achieve Efficient, Compliant Tax Refund Optimization?

This article provides a detailed analysis of the tax refund process for exporting construction tools to the United States, covering policy benefits, market access barriers, and the entire agency tax refund process. It highlights common risks such as incorrect product classification and document discrepancies, along with mitigation strategies. It emphasizes that selecting professional agency service providers can optimize costs and manage risks, demonstrating cost reduction and efficiency improvement through real-world case studies.

PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912